Your subscription brand is leaking revenue—and you probably don't even know how much. Failed rebills, expired cards, and processor declines silently cancel thousands of subscriptions every month. This isn't customer churn. It's payment infrastructure failure. And it's costing the average subscription brand 9-15% of monthly recurring revenue.

The Silent Revenue Killer: Involuntary Churn

There are two types of churn in subscription ecommerce. Voluntary churn—when a customer actively cancels—gets all the attention. Brands build elaborate retention flows, cancellation surveys, and win-back campaigns. But the bigger problem hides in plain sight: involuntary churn, when subscriptions die because payments fail.

Industry data shows involuntary churn accounts for 20-40% of total subscription cancellations. These are customers who want your product, who intended to keep paying, but whose payment silently failed. Their credit card expired. Their bank flagged the charge. The processor had a temporary outage. And your system gave up after 2-3 generic retries.

For a subscription brand doing $500K/month in recurring revenue, that's $45K-$75K in preventable losses every single month. Over a year, that's more than half a million dollars walking out the door—not because customers left, but because your payment infrastructure failed them.

Why Standard Payment Setups Fail at Subscriptions

Most subscription brands start with a single payment processor—usually Stripe. And Stripe is excellent for initial transactions. But subscription rebills have fundamentally different characteristics than one-time purchases:

Card-on-file transactions have lower approval rates

Rebills are "merchant-initiated transactions" (MITs), which face stricter scrutiny from issuing banks. First-transaction approval rates of 92-95% drop to 80-85% for recurring charges.

Generic retry timing wastes attempts

Most processors retry at fixed intervals (24h, 48h, 72h) regardless of why the payment failed. Retrying an "insufficient funds" decline at 2am when the customer just got paid at midnight misses the window.

Single-processor dependency creates fragility

If your only processor has an outage or flags your MID, every subscription fails simultaneously. No failover. No redundancy. Revenue stops until the issue resolves.

The Payment Recovery Playbook

High-growth subscription brands that solve this problem share a common playbook. Here's what separates brands recovering 40-60% of failed payments from those recovering 15-20%:

1. Decline-Code-Aware Retry Logic

Not all declines are equal. "Insufficient funds" should retry at the start of the next billing cycle. "Do not honor" should retry on a different processor. "Expired card" should trigger a card update flow, not a retry. Intelligent systems read the decline code and adapt.

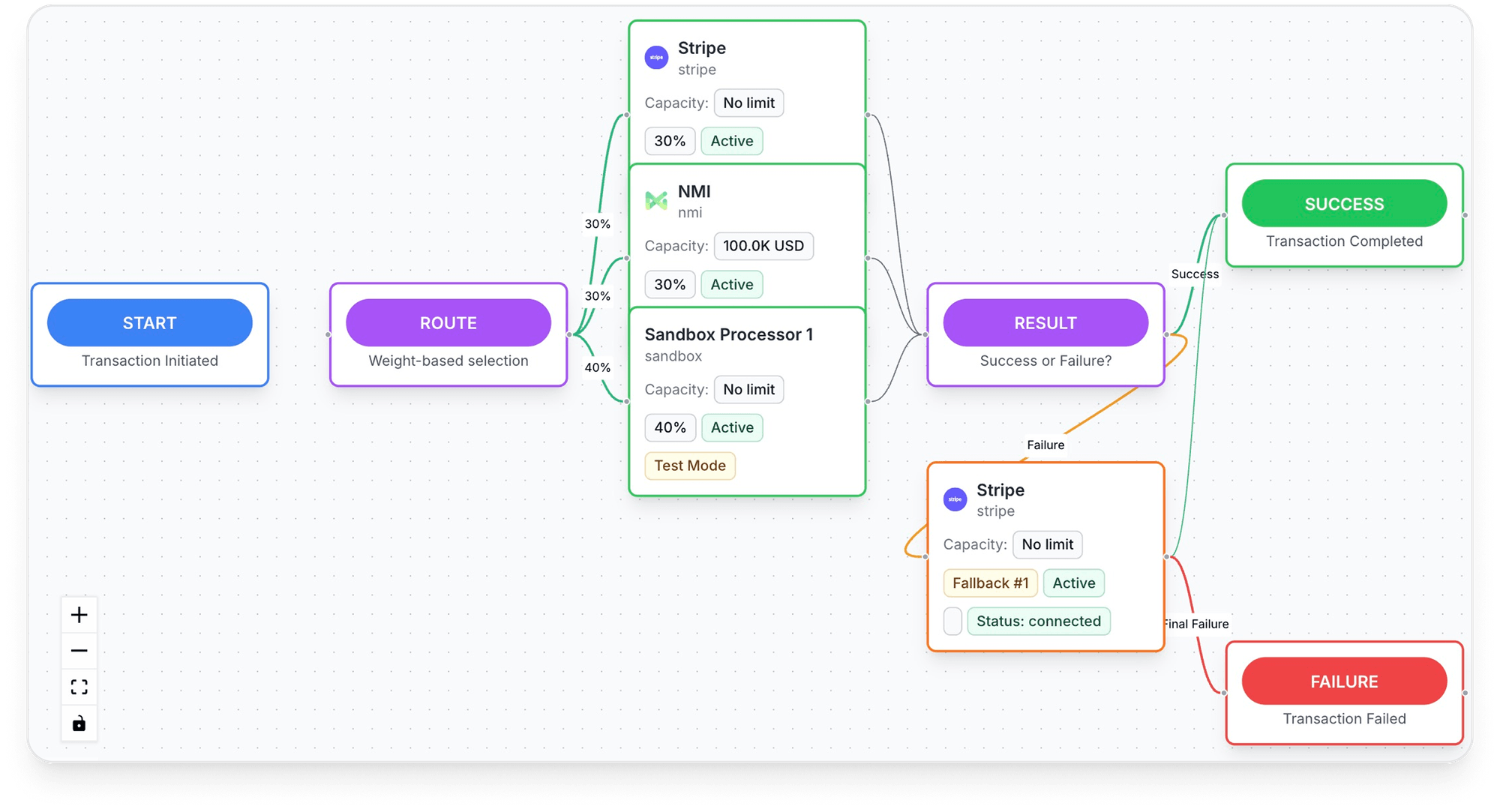

When Processor A declines a rebill, route the retry to Processor B. Different processors have different relationships with different issuing banks. A card that declines on Stripe may approve on Adyen or NMI. This alone can recover 5-10% more failed payments.

3. Network Token Updates

Card networks (Visa, Mastercard) offer automatic card updater services that refresh expired card details before charges fail. Brands using network tokens see 3-5% fewer "expired card" declines. This is free revenue recovery that most brands don't activate.

4. Context-Aware Dunning

Generic "Update your payment method" emails get 15-20% open rates. Emails that reference the specific failure reason, the specific product, and offer a one-click update link see 35-45% open rates. Your dunning system needs to know why the payment failed to communicate effectively.

How Tagada Solves Subscription Payments

At Tagada, subscription payment recovery isn't an add-on—it's core infrastructure. Because our unified commerce platform owns the entire customer journey—checkout, payments, subscriptions, and communications—we can do things that fragmented systems simply can't.

Our smart retry engine analyzes the decline reason code, the customer's payment history, the card type, the issuing bank, and the time of day to determine the optimal retry strategy. If the primary processor declines, the system automatically cascades to the processor most likely to approve that specific card.

The result: our merchants consistently recover 30-50% more failed subscription payments than single-processor setups. For a brand doing $1M/month in subscriptions, that translates to $30K-$75K in additional monthly revenue—with zero additional ad spend.

The Bottom Line

Every subscription brand obsesses over acquisition costs and voluntary churn rates. But the highest-ROI investment most subscription brands can make is fixing their payment infrastructure. The customers are already there. They already want your product. You just need payments that don't fail them.

If your subscription brand is doing $100K+ in monthly recurring revenue and you're still running a single-processor setup with generic retry logic, you're leaving 10-15% of your revenue on the table. That's not a rounding error—it's a strategic gap.